The Well-Oiled Machine: PrimeEnergy Resource's Decade-Long Setup (PNRG)

When Conservative Becomes Compelling

Executive Summary

PrimeEnergy Resources Corporation ("PNRG") presents a compelling investment opportunity at its current price of $193 per share as we see 55% upside by year-end 2025, representing a target price of $300. The investment thesis is predicated on significant near-term production growth from a fully-funded drilling program and excellent operating metrics, all while trading at an attractive valuation of 20% LTM FCF yield despite an 81% YTD return.

The Company stands out among small-cap E&Ps due to its exceptional capital allocation track record, industry-leading cost structure, and substantial insider ownership. Under the leadership of its founder/CEO, PNRG has retired 76% of shares outstanding since its IPO 34 years ago while maintaining a conservative balance sheet. The Company is now executing on a long-planned growth strategy, with production expected to reach 20,000 boepd in 2025, up from 8,160 boepd at year-end 2023.

Key Facts

Price: $190

Fully Diluted Shares Outstanding: 2,485,000

Fully Diluted Market Cap: $472 Million

Insider Ownership: 70-80%

Production growth (boe): 113% year over year

Debt: No long term debt, some intra-quarter borrowings

Company Background

PrimeEnergy Resources Corporation represents a unique case study in measured, disciplined growth within the U.S. energy sector. Founded 34 years ago, the Company has built a diverse asset portfolio centered on its core West Texas operations, complemented by strategic positions in Oklahoma, offshore Texas, and West Virginia. This geographic diversity provides operational flexibility while maintaining focus on the prolific Permian Basin, where the Company holds 10,000 net acres in some of the region's most productive areas.

The Company's approach to the shale revolution exemplifies its conservative, long-term focused strategy. While many peers aggressively pursued shale development during the 2014-2019 period, often at the expense of their balance sheets, PNRG maintained a measured pace of development. Their horizontal drilling program, initiated in 2015, demonstrates this disciplined approach. Through Q1 2021, the Company participated in 77 carefully selected wells, with PNRG taking meaningful positions (averaging 30.75% working interest) in 62 wells while maintaining smaller, strategic interests (less than one percent) in 15 wells. This selective approach to working interest participation reflects management's focus on capital efficiency and risk management.

PNRG's development strategy entered a new phase following the COVID-19 downturn. While the Company had invested in six new horizontal wells in 2020 ($4 million invested) and three additional wells in Q1 2021 ($3.2 million invested), the broader development program was temporarily paused during market uncertainty. This conservative approach preserved capital during a challenging period and positioned the Company for its current acceleration.

Since the start of our West Texas horizontal drilling program in 2015 and through the first quarter of 2021 the Company has participated in 77 horizontal wells in the Permian Basin, one of which was drilled and brought into production in 2020. As of year-end, the Company has invested approximately $108 MM in this drilling program, including over $4 million in six wells drilled in 2020 that will be completed in 2021. In addition, the Company has invested another $3.2 million in three new horizontals drilled in the first quarter of 2021. All nine of these wells are designated as proved undeveloped in the year-end reserve report and are to be completed and on-line by the end of the second quarter of 2021. Of the total 77 horizontal wells in this program, the Company has an average of 30.75% interest in 62 wells, and less than one percent interest in 15 wells. (2020 10-K)

The Company's current growth phase represents the culmination of years of careful planning. The 2024-2027 development program, which includes $84 million committed to 30 new horizontal wells in 2025 and an additional $69 million planned for 21 wells in 2026-2027, builds on the technical and operational knowledge gained from their initial horizontal program. This acceleration comes at a time when the Company's operational capabilities, balance sheet strength, and market conditions all support increased development activity.

Management and Governance

PNRG's management structure and corporate governance framework represent a unique combination of founder-led stability and significant insider alignment. The Company's leadership is anchored by its founder and CEO, who has guided the organization for over three decades, maintaining a consistent focus on disciplined growth and shareholder value creation. This continuity of leadership has fostered a corporate culture that prioritizes long-term value creation over short-term market dynamics.

The depth of management's commitment to shareholder alignment is evidenced by their substantial ownership position. Insiders control 70-80% of shares outstanding, with the founder/CEO personally holding 520,644 shares and 767,500 options, representing approximately 52% of the fully diluted share count. This concentrated ownership structure has ensured management's interests are directly aligned with those of shareholders.

The Company's capital allocation track record demonstrates the effectiveness of this aligned governance structure. Since its IPO, PNRG has retired 76% of its shares outstanding while maintaining a conservative balance sheet. Unlike many peers who pursued aggressive growth during the shale boom, often at the expense of shareholder returns, PNRG's management maintained capital discipline. The Company's approach to returning capital has historically favored share repurchases, with each decision carefully weighed against reinvestment opportunities.

Historical Production

The Company's measured approach to development is evident in its historical production and capital spending. Despite minimal capital investment of $16-21M annually during 2020-2022, PNRG maintained stable production around 5,000 boepd. The 2023 acceleration to $113.8M in capital expenditures has driven significant production growth as evidenced below.

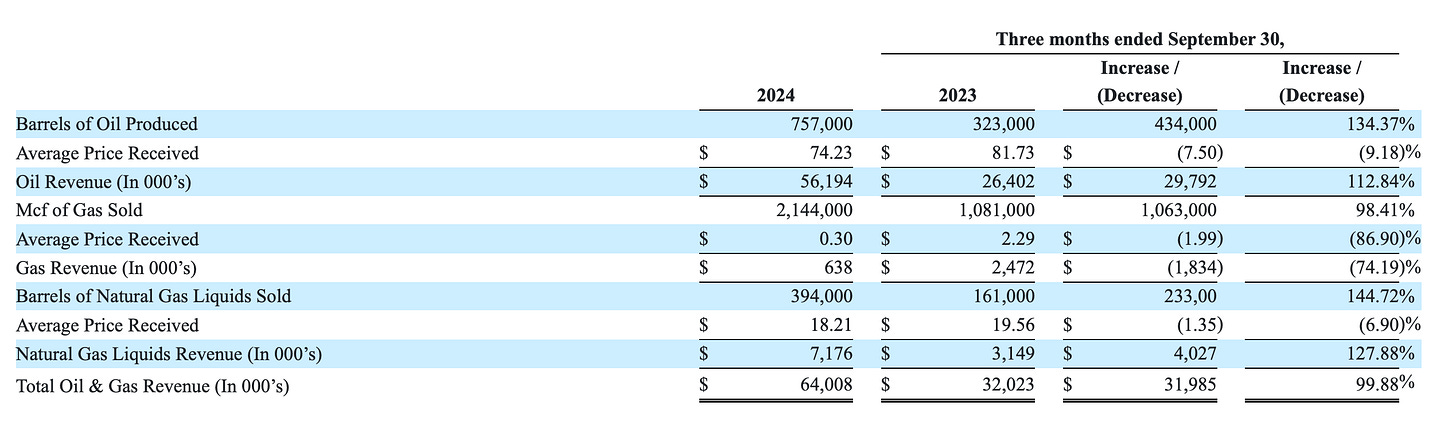

Operating Performance Analysis

Recent operating results validate management's growth strategy. The Company's current run-rate production of 16,530 boepd (as of Q3 2024) represents a doubling from year-end 2023 levels. This growth has been achieved through the successful execution of their 2024 drilling program, which includes 14.28 net new wells at a total capital cost of $113.8 million.

Well performance data has been impressive. The Studley CKO wells, online for eight months, have produced at a gross rate of 10,835 boepd (2,134 boepd net to PNRG's 19.7% interest). The Christi wells, with 4.5 months of production history, are producing 15,627 boepd gross (6,251 boepd net to PNRG's 40% interest). The most recent Honey RF wells, though still ramping up after 1.5 months, are producing 4,620 boepd gross (2,310 boepd net to PNRG's 50% interest).

The production mix of 48% oil, 24% gas, and 29% NGLs provides balanced commodity exposure while maintaining attractive margins. The Company's decision not to hedge allows for full participation in commodity price upside, though this can be managed at the portfolio level by pairing with short positions in weaker E&P names if desired.

Comparable Analysis

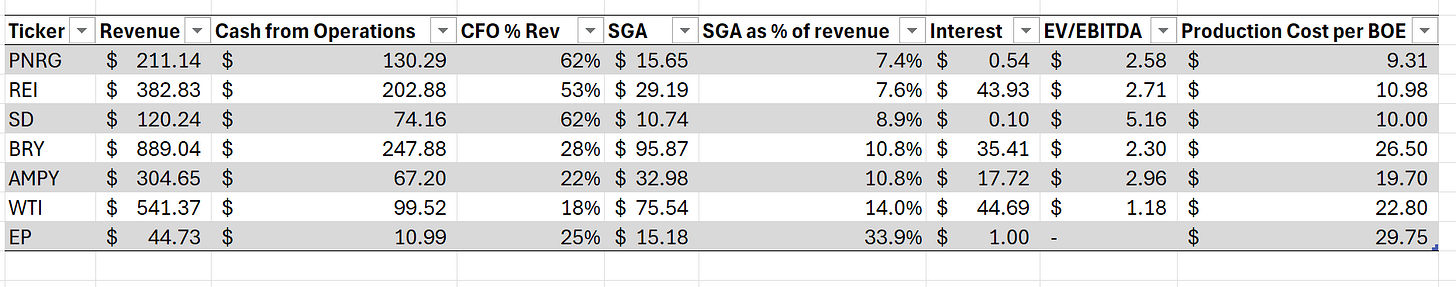

PNRG demonstrates industry-leading metrics across key operational and financial measures:

The Company has the lowest production costs in its peer group at $9.31/boe, compared to the peer average of $18.43/boe.

BIts SG&A expenses are best-in-class at 7.4% of revenue, well below the peer average of 13.4%.

The Company's cash flow conversion is exceptional, with CFO representing 62% of revenue, tied for highest among peers with SD.

PNRG maintains conservative leverage, with interest expense of only $0.54M compared to the peer average of $23.90M.

Growth Strategy and Catalysts

PNRG's growth strategy is fully funded and clearly defined. The 2024 program of 14.28 net wells is already showing strong results, with 9 wells currently producing. Looking forward, the Company has committed $84 million to 30 new horizontal wells in 2025 and plans an additional $69 million for 21 wells in 2026-2027 as evidenced below.

In total, in 2024, we completed 56 new horizontal wells, investing approximately $141 million and the six wells with Apache in Upton County, Texas that are in the process of being completed are expected to come on line after the first of the year. We are also actively investing or preparing to invest approximately $84 million in 30 new horizontal wells, including six 3-mile-long horizontals with Apache now in the process of being completed in Upton County, Texas, that are expected to be completed and put on production in 2025. In addition, we have identified 21 horizontal locations for future development of the Upper Wolfcamp and Spraberry, primarily in Martin and Upton Counties that we anticipate will be drilled in the 2026-2027 timeframe which would require a net investment of approximately $69 million. (2024 Q3 10-Q)

Production Forecast and Valuation

Our 2025 production forecast of 20,000 boepd is built upon a granular well-by-well analysis that incorporates conservative decline assumptions and demonstrated well performance. The forecast begins with the current production base of 16,530 boepd, which consists of two distinct components: legacy vertical wells contributing approximately 6,000 boepd and new 2024 horizontal wells providing approximately 10,000 boepd. The legacy vertical wells, which have demonstrated remarkable stability over decades of operation, are expected to decline at a modest 10% annual rate, contributing approximately 5,400 boepd to our 2025 forecast. The 2024 horizontal wells, while currently producing at impressive rates, are modeled with a conservative 60% first-year decline rate based on typical Permian Basin type curves, suggesting a 2025 contribution of approximately 4,000 boepd.

Additional production growth will come from two primary sources. First, the remaining 5.28 wells from the 2024 program (14.28 total wells less 9 currently producing) are expected to add approximately 2,600 boepd, based on the demonstrated average of 1,000 boepd per net well. Second, the 2025 drilling program, which includes 30 gross wells at an average 40% working interest, is projected to contribute approximately 8,000 boepd. This estimate conservatively assumes 800 boepd per net well, a 20% discount to current well performance, despite targeting similar geological formations with proven well designs.

Our $300 target price is supported by multiple valuation approaches, with the primary methodology based on free cash flow yield. At $65 oil and $1 gas, our sensitivity analysis indicates PNRG will generate $112.4 million in steady-state free cash flow, implying a 15% yield at our target price. This yield is consistent with PNRG's historical trading pattern and remains conservative relative to small-cap E&P peers. Notably, this valuation excludes two sources of potential upside: the Company's 60-mile offshore pipeline and the 30,000-acre West Virginia royalty interest. A key assumption here is that maintenance capital expenditures are $30 million per year, roughly double the historic level.

Our forecast also maintains conservatism in the face of potential upside. If PNRG's new wells continue to perform at current levels rather than our discounted assumptions, production could reach 25,000 boepd. At the same FCF yield, this would imply a share price of $375. This scenario is well supported by the Company's extensive drilling inventory and demonstrated ability to fund growth through operating cash flow, providing a clear path to additional value creation beyond our base case assumptions.

Risks and Mitigants

The primary risks to our thesis are:

Execution Risk: While future wells may not match current performance, our production forecasts incorporate conservative decline assumptions and efficiency estimates. The Company's track record of conservative operations and strong well results provides confidence in their execution capabilities.

Commodity Price Risk: PNRG's unhedged production profile creates direct exposure to commodity prices. However, the Company's industry-leading cost structure provides significant downside protection, and the position can be paired with shorts in higher-cost producers if desired.

Well Decline / Maintenance Risk: It is possible that the newly drilled wells decline faster than modeled and, thus, additional maintenance capital expenditures are required to maintain flat production.

Other risks to consider include:

Liquidity Risk: The stock's thin trading volume can lead to significant price volatility, as evidenced by a 20% decline on December 6th when only 20,000 shares traded.

Conclusion

The PNRG investment opportunity offers multiple ways to win. The organic growth case alone delivers 55% upside through production growth and multiple expansion to historical levels. A potential sale of the Company could provide additional upside through an M&A premium. A recent comparable sale is the APA Permian divestiture where 21,000 boepd net production was sold for $950MM. This translates to $45,238 per boepd or roughly a $382 fully dilute price for PNRG. Meanwhile, the current 20% FCF yield provides attractive returns even if growth and strategic outcomes take longer than anticipated.

Key considerations supporting the investment include:

Excellent operating metrics and cost structure

Exceptional alignment through 70-80% insider ownership

Fully funded growth program with visible catalysts

Conservative assumptions in production and valuation forecasts

Multiple routes to value realization

The combination of visible production growth, top-tier operating metrics, and potential strategic optionality provides compelling upside with multiple paths to success.